Understanding SOPR

Before diving into the analysis, it's essential to understand what SOPR is. The Spent Output Profit Ratio is a Bitcoin market metric that investigates the profit or loss ratio of spent outputs. In simpler terms, it measures whether Bitcoin owners are selling their assets at a profit or loss by comparing the price at which Bitcoin was bought (the price when it last moved) to the price at which it was sold.

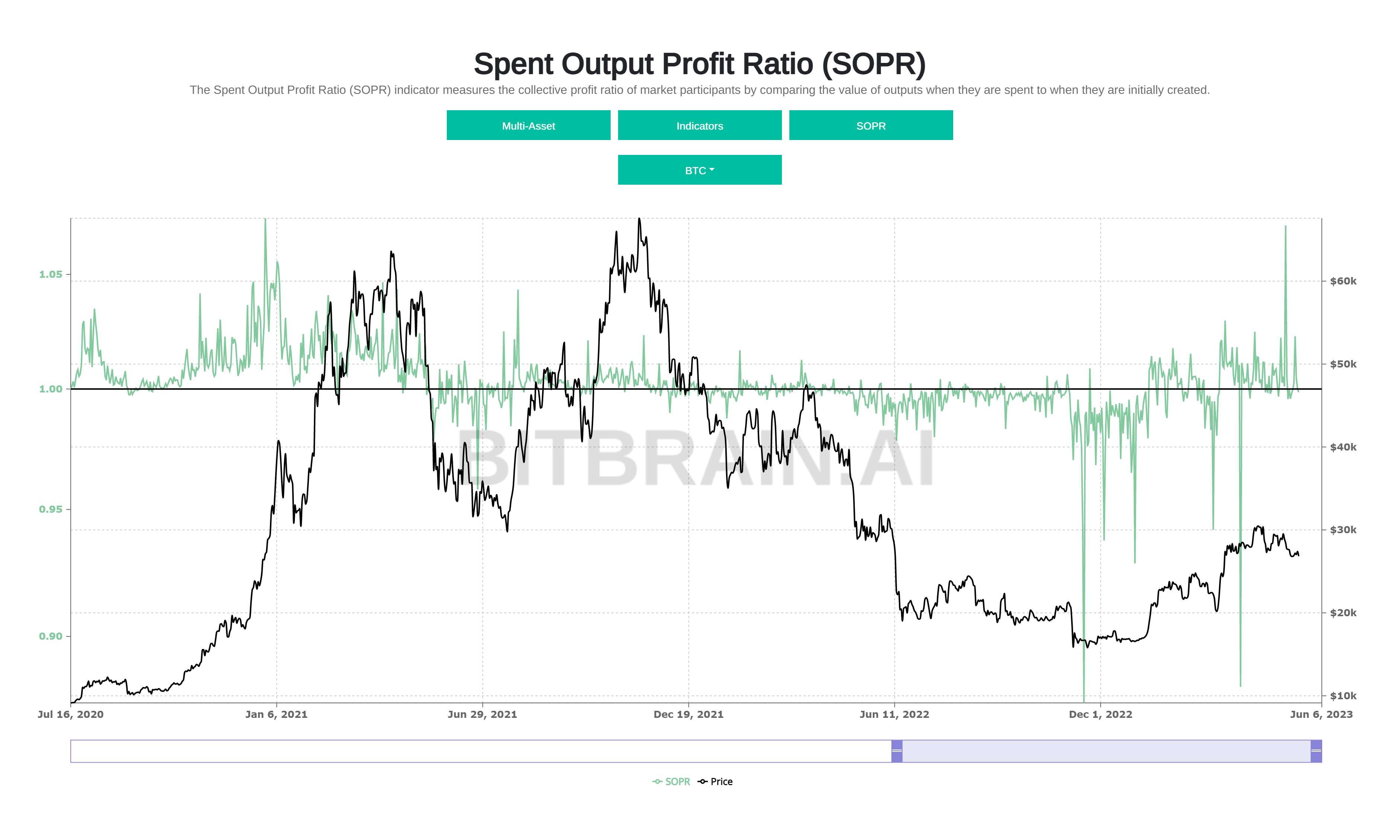

A SOPR value of 1 indicates people are selling their Bitcoin at the price they bought it, i.e., at break-even. If the SOPR is greater than 1, it suggests that, on average, coins being transacted were last moved at a lower price than the current one, indicating people are selling at a profit. On the other hand, a SOPR value below 1 signals that people are selling at a loss.

Deciphering SOPR's Signals

With the basic understanding of SOPR out of the way, let's delve into the crux of this article. On May 6th, 2023, Bitcoin's SOPR spiked to 1.0721. Interestingly, the last similar spike occurred back in December 2020, right before an explosive bull run in Bitcoin's price. What could these spikes signify?

1. A Bullish Sentiment

A surge in the SOPR generally points towards a bullish market sentiment. When the SOPR value exceeds 1, it shows that people are, on average, selling their Bitcoin at a profit. This change of hands, from old to new owners, reduces the sell pressure, provided the new owners firmly believe in their investment. The notion that most sellers are bagging profits implies the overarching trend for Bitcoin is on an upward trajectory.

2. Profit-Taking Could Lead to Short-Term Price Corrections

Another plausible interpretation could be a looming short-term price correction. A SOPR spike might lead to an influx of individuals cashing out their Bitcoins to realize these profits. This activity could drive the price down temporarily. However, if the market's fundamentals remain strong, such dips are often short-lived and may be followed by a rebound.

3. A Clue to Institutional Activity

Spikes in SOPR can sometimes be linked to increased institutional buying activity. Institutions often purchase during high SOPR periods, speculating that after individuals have sold their coins for profit, the reduced selling pressure will lead to a price increase.

Looking Forward: What's Next for Bitcoin?

In this particular scenario, where the SOPR previously soared in December 2020, followed by an impressive bull run, the latest spike could be hinting at another potential surge in Bitcoin's price.