Bitcoin's price has been hovering around $27,000 for the past week or so, crypto Twitter is back on meme mode, and besides news on Hong Kong and SBF, there's not much going on, or is there?

While the surface may appear calm, a closer examination of Bitcoin's on-chain activity reveals a dynamic landscape teeming with insights and potential opportunities.

Bitcoin's Reserve Risk

We are still quite early, the Reserve Risk has been screaming a buy signal for the past year now and although we've seen price rise above $30,000, reserve risk has not really moved much past the lower threshold of 0.0010. It's also quite safe to say that we've already hit a cycle low at $15,000 which also corresponds with the lowest reserve risk has ever been, even lower than the worst cycle low in 2015. So although I think price might fluctuate in the near future, I don't really see it going back into the teens anytime soon.

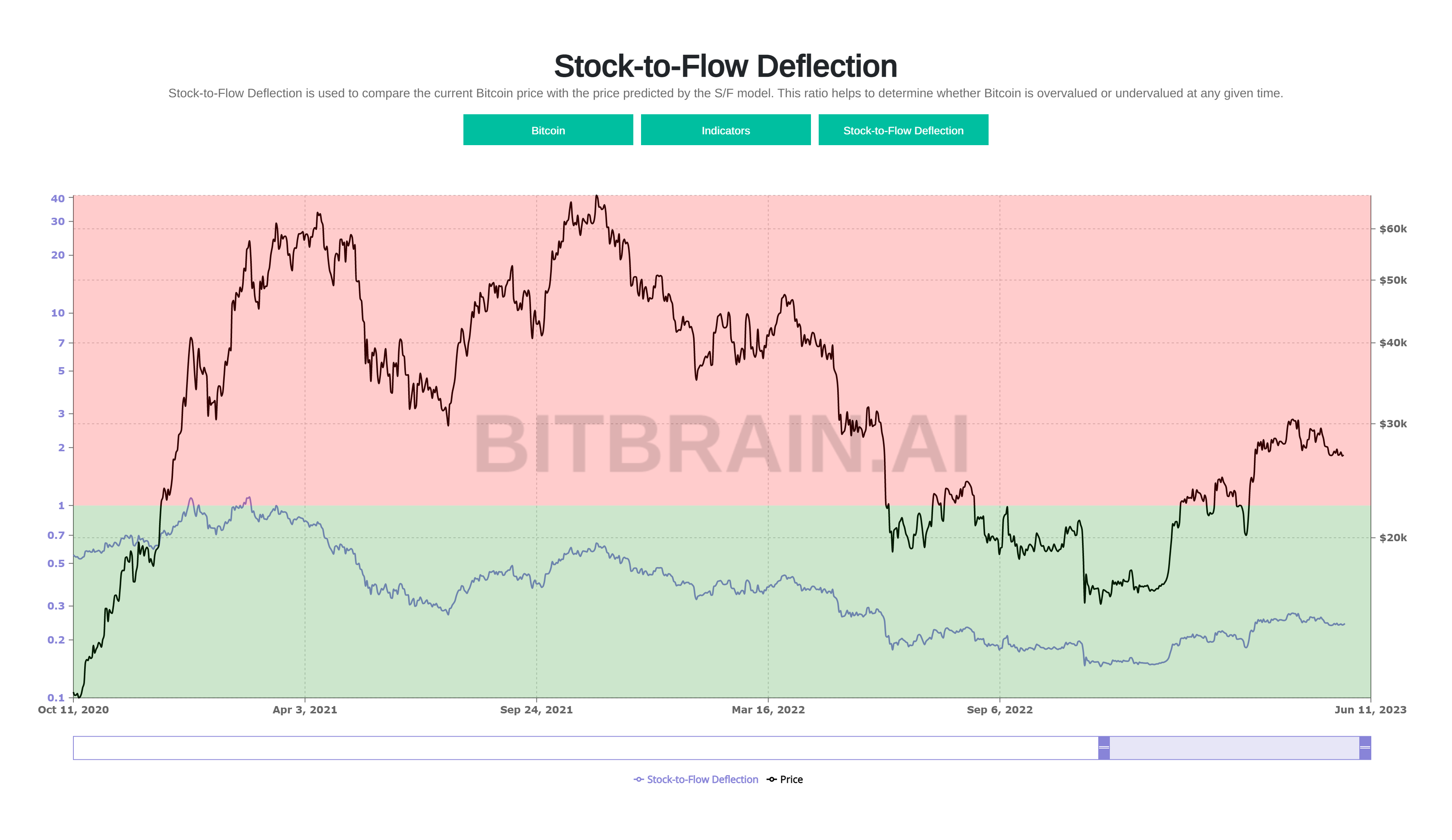

Bitcoin's Stock-to-Flow Deflection

The stock-to-flow deflection's last value was at 0.24, way below 1, which would be on par with Bitcoin's stock-to-flow model, again this is uncharted territory and so far if this metric is still intact, it's suggesting now is the time to buy for generational wealth. That being said, I think the stock-to-flow deflection presents great opportunities when paired with divergences, and so far none have appeared in either direction, so my bias of the stock-to-flow deflection alone is neutral, maybe slightly bullish based on context.

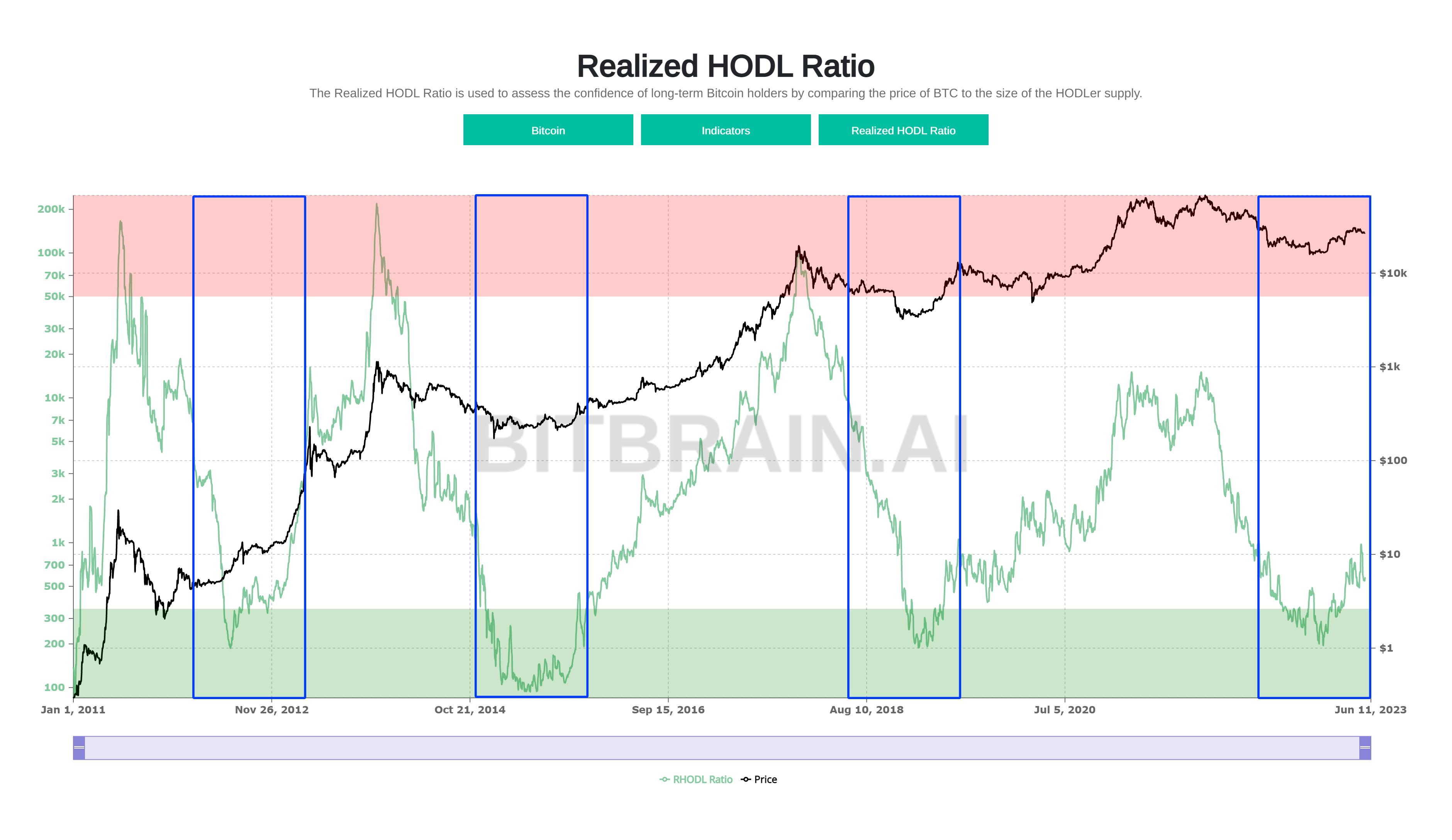

Bitcoin's Realized Hodl Ratio

The realized hodl ratio paints a slightly different picture, in the past when the RHODL sunk into the green threshold and bounced back above, it was led by a strong movement in price. This has already happened and the RHODL has already cleared the green area, signifying that were already at the early stages of a bull market. Judging by the previous dips, we are looking at similar price movements to 2012 and 2019.

Therefore it's safe to say these metrics suggest a favorable climate for those seeking to bolster their portfolios for long-term prosperity. We are seeing on-chain evidence of early-stage bull market conditions reminiscent of previous dips.