In the last few years, the world has been caught in a whirlwind of a paradigm shift. This revolution, led by decentralized finance (DeFi), is on the cusp of reshaping the very foundation of our financial systems. With its promise of democratizing access to financial services and its rapid, yet organic growth, DeFi has firmly planted its roots in the global economic landscape.

The DeFi sphere is a hotbed of innovation, where ingenious minds constantly push the boundaries to unlock new financial opportunities. From lending and borrowing platforms to decentralized exchanges, yield farming, dapps, and layer 2 protocols, DeFi has breathed life into a financial ecosystem that is not only transparent and permissionless but also capable of offering lucrative opportunities.

Yet, while the promise of this decentralized world is thrilling, it doesn't come without its share of challenges. The landscape is vast and ever-evolving, keeping pace with the latest protocols and platforms is no small feat. With an intimidating array of projects, each more complex and innovative than the last, newcomers often find themselves lost in a maze of technical jargon and endless options.

Our mission with this article is to cast a light on some of the lesser-known, yet profoundly innovative DeFi protocols that are reshaping the industry. By bringing these hidden gems to the forefront, we hope to make the DeFi landscape a little more navigable for both the uninitiated and the seasoned veterans. Buckle up as we embark on this exciting journey of exploring the Top 14 Cutting-Edge DeFi Protocols you need to know about.

1. Smilee Finance

Website | Twitter | Whitepaper

Industry: Exchange

For anyone who has dipped their toes in the waters of Automated Market Makers (AMMs), the term "Impermanent Loss" (IL) isn't new. Recognizing IL as an inherent part of the system, Smilee Finance leverages its potential by facilitating traders to capitalize on price volatility.

At the heart of Smilee's protocol are on-chain options and derivatives that foster robust volatility trading. One of its unique propositions is the transformation of IL from a drawback to an advantage, through its "Impermanent Gain" and "Real Yield" offerings.

This ingenious system allows users to bet against volatility (similar to Liquidity Providing on an AMM), while simultaneously reaping a yield. For those who prefer taking on the risk, Impermanent Gain options with up to 5,000x leverage and no risk of liquidation offer an exciting opportunity. By doing so, Smilee provides a platform for Liquidity Providers to hedge against IL and enables traders to speculate on price volatility.

Recently, Smilee revealed elements of its forthcoming Smilee v1.69 update. This includes a synthetic AMM and Directional Impermanent Gain options, equipping traders with the flexibility to enter and exit positions at will, and double their leverage by predicting volatility direction.

Thanks to its adaptable synthetic engine, Smilee is capable of offering a plethora of unique derivative payoff structures. This includes but isn't limited to impermanent gain, options, token swaps, structured products, and insurance.

2. Aevo

Website | Twitter

Industry: Exchange

Aevo is an innovative order-book options exchange, brought forward by the Ribbon Finance team. It operates on the Aevo Chain, a tailor-made OP Stack rolldApp – a layer 2 solution that's designed on Optimism's code base, dedicated solely to servicing the Aevo Exchange.

Drawing a parallel to the renowned options provider dYdX, Aevo utilizes an off-chain order-book while executing matched transactions on-chain with its smart contracts.

At present, the Aevo Exchange extends its services for calls, puts, and futures on ETH. Additionally, the newly-introduced Aevo OTC provides a platform for anyone (provided they can execute a minimum $10k notional trade) to explore options on altcoins. The team has plans in the pipeline to introduce BTC options, expand market maker integrations, and facilitate integration with Ribbon’s DOV vaults in the foreseeable future.

3. OpenEden

Website | Twitter | Docs

Industry: Stablecoins & Real World Assets

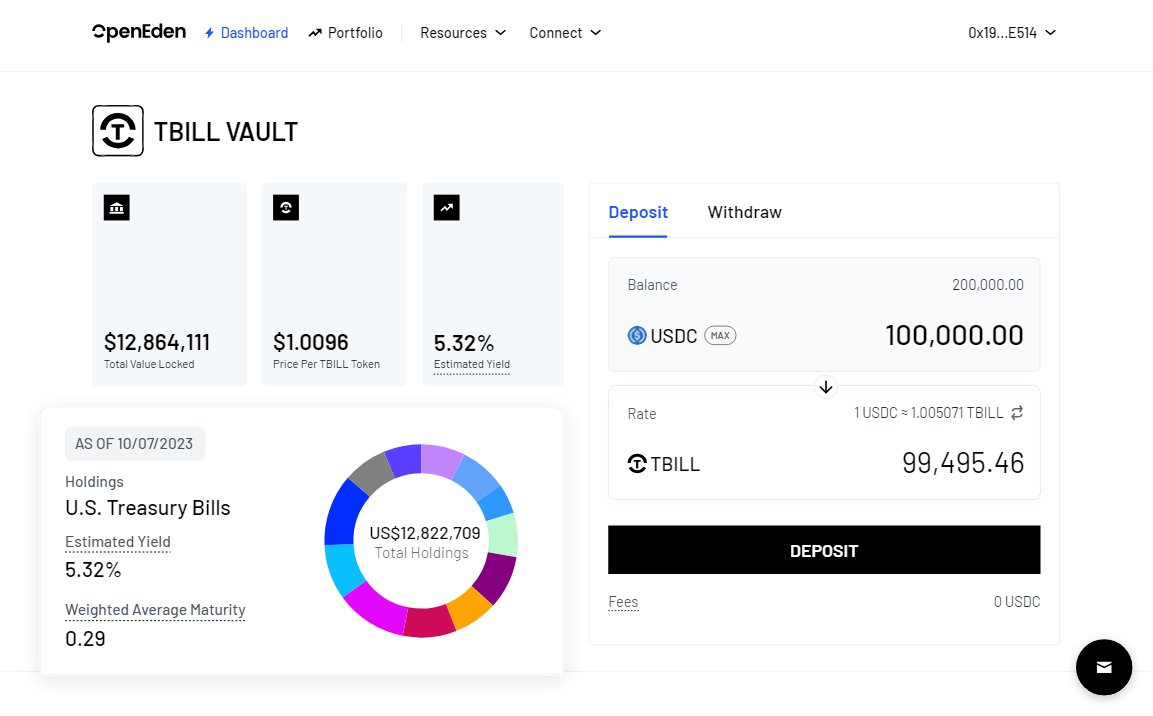

OpenEden sets a new standard in the DeFi space by introducing the first-ever smart contract Treasury Bill vault, operated by an entity that's resistant to bankruptcy and strictly regulated. This unique selling point makes it an exceptionally secure avenue for reaping real-world yields via blockchain technology.

Adherence to compliance norms and transparency are OpenEden's foremost considerations. The collateral pool is managed under the watchful eyes of a fund management firm regulated by the Monetary Authority of Singapore, while token issuance is solely done via a professional fund regulated by the British Virgin Islands Financial Services Commission.

What sets OpenEden apart is its array of user-friendly features, such as real-time attestations for Proof of Reserves by Chainlink and daily reports of custodian reserves. A 5% USDC reserve ensures instant redemptions, enabling immediate liquidity for investors.

4. GammaSwap

Website | Twitter | Docs

Industry: Decentralized Exchange

GammaSwap ingeniously converts liquidity providers' losses into trading opportunities for others.

Being a liquidity provider for Automated Market Makers (AMMs) like Uniswap carries the risk of impermanent loss, which can erase the value of their position as the prices of underlying assets change.

The payoffs that emerge from these liquidity positions bear similarities to the continuously changing short-straddle options in traditional finance markets. This setup involves an investor simultaneously selling put and call options on the same underlying asset, with identical strike prices and expiration dates.

In the current framework, however, LPs do not receive any compensation for crafting these options.

GammaSwap aims to resolve this by creating a marketplace where liquidity providers can be paired with parties eager to benefit from long volatility. This innovative approach enables LPs to tap into an additional yield source from traders or hedge their exposure to impermanent losses.

5. Stream Finance

Website | Twitter | Docs

Industry: Stablecoins and Real World Assets

Stream Finance is on a mission to seamlessly integrate US Treasuries with DeFi and lessen the yield disparity between stablecoins and real-world assets. Their approach is tailored to minimize KYC requirements and allows non-US parties to gain exposure to US Treasuries.

At present, Stream permits users to establish "vaults" for investing in 4-week US Treasury bonds, enabling them to withdraw their principal and accumulated interest at the end of the term. The team has plans to include more asset types in the future, such as corporate bonds.

Flow, a product under development by Stream, aims to provide immediate liquidity to depositor positions. However, it requires users to forfeit a portion of their yield, mirroring the fact that the smart contract needs to maintain liquid assets to fulfill redemptions.

6. Yama Finance

Website | Twitter | Docs

Industry: Stablecoins and Leveraged Yield Farming

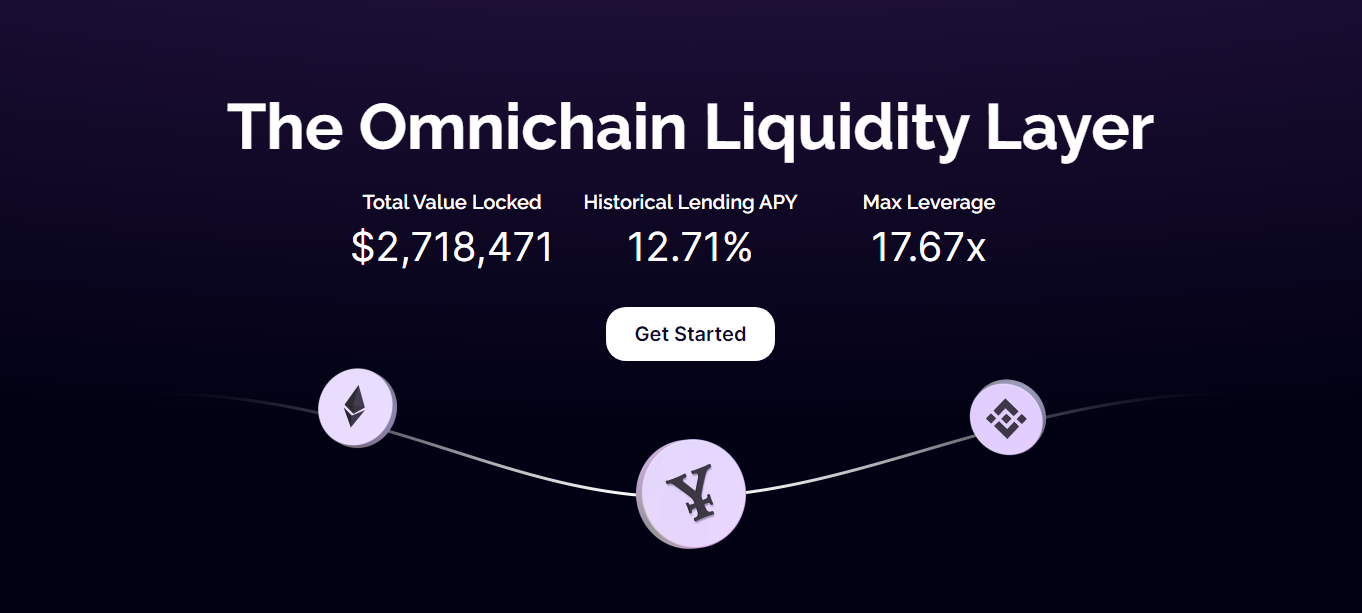

Stablecoins traditionally serve the purpose of preserving value with limited inherent functionality. Yama Finance, however, aims to stimulate the utilization of its dollar-pegged token by satisfying the demand of traders for leverage.

Yama is an innovative omnichain stablecoin, backed by USDT, that uses borrowers' interest to promote native liquidity for token swap transactions. The protocol enables high leverage, up to a 17x multiplier, on collaterals like GLP. Its architecture promises numerous advantages, such as abundant relative liquidity, zero fees or slippage on YAMA/USDT transactions, and exceptionally high APYs for lenders.

Although Yama has yet to fully realize its omnichain capability (it's currently deployed only on Arbitrum), the protocol aspires to become the go-to stablecoin provider for a broad range of rollups and plans to deploy on both Fuel and Eclipse platforms.

7. Sentiment

Website | Twitter | Docs

Industry: Leveraged Yield Farming

Sentiment is designed to address the capital inefficiencies that often plague overcollateralized lending systems. The platform enables permissionless, undercollateralized, and on-chain credit markets, providing users with unique avenues to leverage their positions and engage with approved dApps.

Sentiment's journey has not been without turbulence. In the early part of April, it fell prey to an oracle exploit that led to a loss of $970k and resulted in $1.1M in bad debt. However, the team managed to negotiate a 90% recovery of funds and swiftly implemented a liquidation process, restoring the protocol's solvency in just a few days.

Despite the setback and having to restart their trust-building process with users, the Sentiment team remains resolute and determined.

8. Mero

Website | Twitter | Docs

Industry: Asset Management

Mero operates as a trustless reactive liquidity protocol where participants can simultaneously earn yield and register "Actions" for their idle liquidity.

The distinct concept of "Actions" automatically allocates passive liquidity when and where it is required, thereby enabling funds to yield returns when they are idle.

Users can make the most of their ETH, USDC, USDT, DAI, or FRAX by earning yield until their liquidity is called upon. When required, Mero springs into action, leveraging the registered Actions to trigger collateral top-ups and debt repayments. This system gives users the ability to shield their loans on any Ethereum-based borrowing platforms from potential liquidation.

9. Enzyme

Website | Twitter | Docs

Industry: Asset Management

Powered by its native MLN token, Enzyme Finance serves as a robust platform that allows users to create and scale their investment strategies, ranging from discretionary and robo investing to Exchange-Traded Funds (ETFs) and market-making strategies.

Emphasizing on safety, Enzyme's second-generation platform, built on secure smart contracts, undergoes thorough testing and auditing prior to any mainnet deployments. This approach underlines the platform's commitment to providing a secure and trustworthy environment for its users.

Key Features:

Value: Enzyme facilitates an efficient, secure, and cost-effective environment for setting up and managing your vault. In addition, its in-built accounting tools provide real-time reporting capabilities to depositors, thereby enhancing transparency and trust.

Scalability: Enzyme connects you to a pool of potential investors, making it easier to attract and build a community of supporters. This allows you to concentrate on your core competency - developing innovative investment strategies.

DeFi Protocol: Enzyme provides a gateway to a broad universe of DeFi tokens and protocols. Whether you want to earn yield by lending or providing liquidity, or wish to invest in an insurance mutual, Enzyme offers a comprehensive platform for all your DeFi needs.

Currently, the platform has integrated a variety of renowned DeFi protocols including Aave, Compound, Convex Finance, Curve Liquidity Pools, Idle Finance, Maple Finance, Paraswap, Uniswap v2 and v3, Unslashed Finance, Yearn Vaults, 0x, with more to come.

10. DODO

Website | Twitter | Docs

Industry: Decentralized Exchange

DODO is a decentralized finance (DeFi) protocol and an on-chain liquidity provider that employs an innovative proactive market maker (PMM) algorithm. The key objective of DODO is to offer superior liquidity and price stability in comparison to traditional automated market makers (AMMs).

DODO's distinct PMM pricing mechanism mirrors human trading behavior by using oracles to obtain highly precise market prices for assets. It then furnishes sufficient liquidity close to these market prices, thereby stabilizing the portfolios of liquidity providers (LPs), reducing price slippage, and mitigating impermanent loss by providing arbitrage trading opportunities as rewards.

New crypto projects find a welcoming platform in DODO, which offers free ICO listing through its Initial DODO Offering (IDO). This only requires issuers to deposit their own tokens, eliminating barriers to entry for emerging projects.

DODO's smart contract operates as an ERC20 token on the Ethereum network, ensuring interoperability and seamless integration with the wider Ethereum ecosystem.

11. NEST Protocol

Website | Twitter | Docs

Industry: Decentralized Trading Infrastructure

NEST Protocol is a decentralized trading infrastructure aiming to eliminate the need for market makers and liquidity providers (LPs). It includes three modules - NEST Oracle, NEST Assets, and NESTcraft.

NEST Oracle is designed to provide decentralized on-chain prices.

NEST Assets, generated and burned by the NEST smart contract, serve as currency units for martingale transactions on the platform.

NESTcraft converts various on-chain random sources into a super martingale function library, providing a range of customizable martingale trading options.

One notable development built on NESTcraft is NESTFi, a decentralized perpetual exchange where smart contracts act as the counterparty for traders. In this innovative setup, traders' losses are burned by the smart contract, while profits are minted. By eliminating dependence on LPs or market makers, NESTFi theoretically ensures perpetual liquidity for trading.

The unique characteristic of this model is that traders also become participants in the project. As the number of participants grows, traders have greater potential to profit from an increase in the value of the system's tokens.

Key Features:

Advanced Trading Structures: By employing smart contracts and sharing risk, NEST Protocol eradicates the need for market makers and LPs, providing traders with virtually limitless liquidity.

More Stable Price Oracle: NEST Oracle delivers a stable decentralized price feed, where price attacks would necessitate 51% of network assets. It is open for both price offers and verifiers.

Deflationary Economic Model: Users burn $NEST to purchase financial assets like futures, options, etc. As the quantity of $NEST burned surpasses the $NEST generated, the price of $NEST is driven upwards.

12. Beefy Finance

Website | Twitter | Docs

Industry: Yield Optimization

Beefy Finance is a decentralized, omnichain yield optimizer platform that enables users to earn compound interest on their cryptocurrency holdings. By employing smart contracts to implement and secure a variety of investment strategies, Beefy Finance automatically amplifies user rewards from various liquidity pools (LPs), automated market making (AMM) projects, and other yield farming opportunities within the DeFi ecosystem.

The primary offering of Beefy Finance is 'Vaults', where users stake their crypto tokens. Tied to each vault is an investment strategy that automatically boosts the number of deposited tokens by compounding yield farm rewards back into the initial asset. Despite the term 'Vault', users' funds are never locked within Beefy Finance, allowing for withdrawal at any time.

As with many DeFi applications, Beefy Finance is permissionless and trustless. Any individual with a supported wallet can interact with it, eliminating the need for a trusted intermediary. While funds are staked in a vault, users retain full control of their crypto assets.

13. C.R.E.A.M. Finance

Website | Twitter

Industry: Decentralized Lending

C.R.E.A.M. Finance, an acronym for Crypto Runs Everything Around Me, is a decentralized lending protocol that provides financial services to individuals, institutions, and protocols. As a part of the yearn.finance ecosystem, it is a permissionless, open-source, and blockchain-agnostic protocol that caters to users on Ethereum, Binance Smart Chain, Polygon, and Fantom.

Just like a traditional savings account, C.R.E.A.M. allows passive holders of Ether or wBTC to deposit their assets and earn yield. For more details, visit https://app.cream.finance/.

C.R.E.A.M. Finance was conceived as a fork of the Compound Finance protocol. It promotes an inclusive network development through its open-source, permissionless, and blockchain-agnostic nature and offers yield farming rewards to its users.

The project made an unanticipated launch on the Ethereum network on August 3, 2020, via the YOLO liquidity pool. It then went live on the Binance Smart Chain (BSC) in September 2020.

The CREAM token offers multiple utilities to its users, allowing them to lend, borrow, stake assets, and govern the network. Users can vote on which assets to support or delist from the platform.

14. ParaSwap

Website | Twitter | Docs

Industry: DEX Aggregator

ParaSwap is a DeFi middleware and aggregator that amalgamates the liquidity of various decentralized exchanges and lending protocols into a single secure, comprehensive interface and APIs. By consolidating all these pools, it offers the best exchange route for any asset pair, be it for spot trading, limit orders, or even NFT trading. Users can either utilize the interface for best rate exchanges or embed the top rates and liquidity into any project via the APIs. In essence, ParaSwap serves as the primary gateway to optimal liquidity in the DeFi space.

Our mission is to proliferate DeFi participation by offering secure, intelligent, and optimized trading solutions. These facilitate both individuals and institutional traders to tap into the fragmented liquidity pools effortlessly.

Key Features:

Robust API: A public library that is available for smooth integration into dApps and Wallets. Additionally, corporate clients have access to a dedicated API key ensuring superior reliability.

Advanced Charts: Integrates with over 100 protocols across multiple L1 and L2 chains. Enhanced open liquidity with exclusive pricing from top market makers.

Multichain Support: Currently supports multiple blockchains, including Ethereum Mainnet, Binance Smart Chain, Avalanche, Polygon, Fantom, Arbitrum, and Optimism.

Onchain RFQ: The ParaSwap Pool is an on-chain Request for Quotes system. It aggregates real-time quotes from KYC-validated and trusted market makers, thereby offering prices to all our users.

Yield Optimizer: A solution designed to optimize lending rates on various lending protocols.