Tired of leaving your Ethereum (ETH) idling in your wallet while the crypto world buzzes around you? Welcome to the lucrative world of ETH staking, where you can put your idle ETH to work and earn staking rewards.

Staking Ethereum is the heart of its consensus mechanism, enabling the network to function in a secure and decentralized manner. By staking your ETH, you are supporting the network's operations, such as validating transactions and producing new blocks. In return, you earn rewards on your staked ETH - a sweet deal, right? But if you're feeling a bit tech-shy or find the staking process overly intricate, liquid staking has got your back.

Now, let's talk liquid staking. Simply put, it's an ingenious solution that allows anyone, and I mean anyone, to participate in ETH staking without having to navigate the technical hurdles of running a node or risking the potential of penalties. When you go for liquid staking, your staked ETH is represented by a liquid staking derivative (LSD), an ERC20 token that you can trade, sell or hold. The beauty of it all? Your staking rewards accumulate over time, giving you a straightforward "buy-and-hold" approach to ETH staking.

Why is it becoming a hot favorite among crypto enthusiasts, you ask? Well, it's as simple as this - it offers the best of both worlds. You enjoy the eth staking rewards, and the flexibility of having a liquid asset that can be moved around easily.

Understanding Liquid Staking

Alright, now that you've dipped your toes into the world of Ethereum staking. I can already hear you thinking: "Why liquid staking, though?" Trust me, once you've seen the depths of this gem, you'll know why it's making such a big splash.

First off, let's dig into the core idea of liquid staking. When you opt to staking Ethereum in the traditional way, your ETH are, in a sense, "locked up" in the network. They are committed to help secure the Ethereum network and, in return, you earn staking rewards. Simple as that. But here's the rub: while your ETH is staked, it can't be moved or traded. It's like having money in a bank that you can't withdraw - and that's a big no-no in the fast-paced crypto world.

This is where liquid staking comes to the rescue. Picture it as a clever crypto lifesaver that keeps your investments afloat while you enjoy the rewards of staking. In the world of liquid staking, when you stake your ETH, you receive a token (often an ERC20 token) that represents your staked ETH. This token is your Liquid Staking Derivative (LSD), and it can be moved, traded, or sold. Your staked ETH is still working away, securing the network and earning you rewards, but you now hold an LSD that you can use as you please.

Think of it as having your cake and eating it too. Your ETH is both securing the network, earning staking rewards, and remaining as liquid as your morning coffee. Now that's what I call a winning brew!

Alright, so you're probably now thinking: "That's cool and all, but how exactly does this LSD thing work?" Let's dive into the mechanics of these fascinating creatures.

Liquid Staking Derivatives (LSDs) are tokens that represent staked ETH. When you stake your ETH in a liquid staking protocol, your ETH is pooled with others' into a staking pool. This pool of ETH is then used to validate transactions and secure the Ethereum network - just as in traditional staking.

But here's where the magic happens. Once your ETH is in the pool, you get issued an LSD. This LSD is your golden ticket, your claim on the staked ETH. As the staked ETH earns rewards, the value of your LSD also increases. The beauty of this? You can trade, sell, or even use your LSD in DeFi protocols while your ETH is still staked. It's like getting the earning power of a leased car while still being able to drive it around town.

Let's bring it home with an example. Say you decide to stake 10 ETH through a liquid staking protocol. You send your 10 ETH to the protocol, and it goes into a staking pool. You then receive 10 LSDs that represent your stake. Over time, as your staked ETH earns rewards, the value of your LSDs increases. Meanwhile, you can use those LSDs however you please - trade them, sell them, or even use them in DeFi protocols. All the while, your staked ETH is still hard at work, earning you rewards.

In essence, liquid staking is an innovation that brings unparalleled flexibility to Ethereum staking. It takes away the rigidity of traditional staking and replaces it with a fluid, dynamic process that opens up a whole new world of possibilities for your staked ETH.

Top Five User-Friendly Liquid Staking Options

Gitcoin Staked Ethereum Index (gtcETH)

If you're looking to support Ethereum's public goods while staking, then gtcETH is your destination. It is an index token that comprises leading Ethereum liquid staking tokens, and its primary purpose is to fund public goods on the Ethereum network. With a current estimated APY of 2.3%, it may not be the highest-yielding option, but it offers something uniquely valuable - contributing to the Ethereum ecosystem.

Its unique selling point? Users can support Ethereum public goods, earn staking returns, promote decentralization among LSD protocols, and get diversified exposure to these tokens all at once through a single index. To begin staking, simply buy or sell gtcETH on the Index Coop app using the provided swap interface. Remember, gtcETH is not a rebasing token, as staking rewards are reflected in its increasing price over time.

Risks? The primary risk is the lower yield compared to other platforms, which may not be ideal for yield maximizers. However, if you're keen on contributing to Ethereum's public goods, this risk is offset by the satisfaction you'll derive from your contribution.

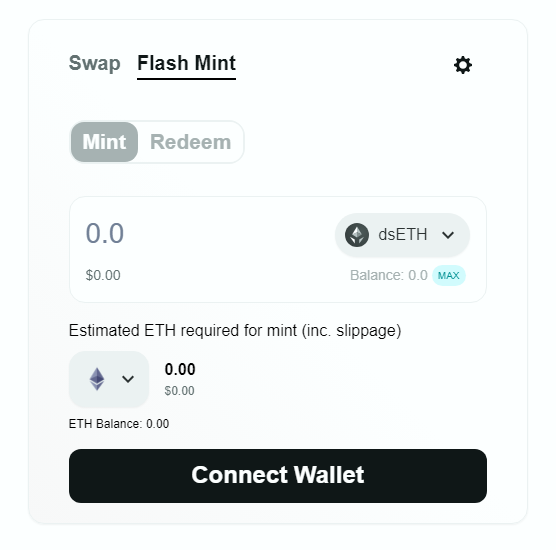

Diversified Staked Ethereum Index (dsETH)

Slightly different from gtcETH, dsETH is another index token that tracks ETH liquid staking tokens but without the public goods funding element. As a result, it offers a higher APY of around 4.3%. Similar to gtcETH, dsETH promotes decentralization and provides reduced price volatility compared to holding a single liquid staking token.

What's its draw? Its primary appeal lies in providing greater returns to holders by eschewing the public goods funding element. The process of staking is identical to gtcETH - just head over to the Index Coop app to buy or sell dsETH. It's also not a rebasing-style token and reflects staking rewards via price appreciation over time.

The risks? dsETH offers higher returns than gtcETH, but it's still not the highest yielding option out there. If you're chasing the highest yields, this might not be your first pick.

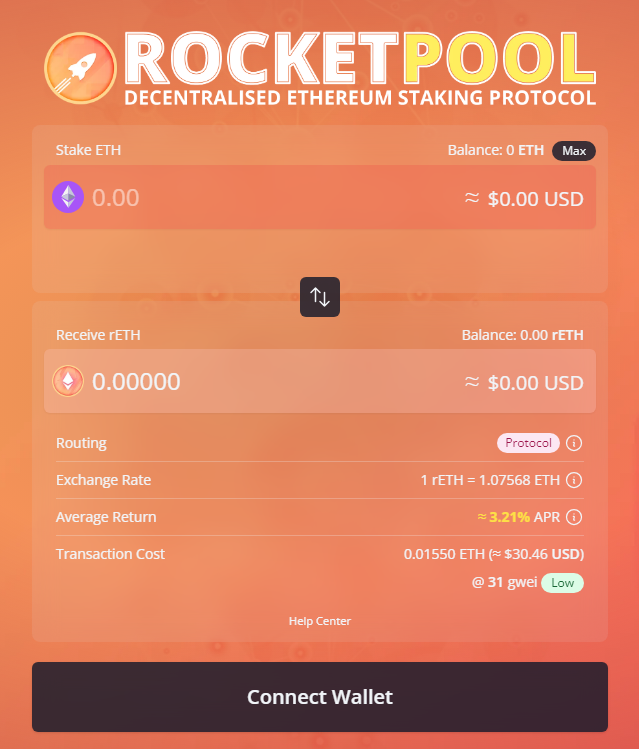

If you're after a combination of a proven track record and a decent yield, Rocket Pool's rETH is a compelling option. With an estimated APR of 4.87%, it's one of the best-yielding staking projects currently. The heart of Rocket Pool's yield is rETH, its tokenized representation of staked ETH that accumulates staking rewards over time.

Why should you consider Rocket Pool? Its decentralized nature and proven track record make it a reliable choice. Staking is as easy as heading to stake.rocketpool.net, entering the amount of ETH you want to stake (must be over 0.01 ETH), and swapping into rETH.

Any risks? As with all staking options, there's always the risk of smart contract bugs or other unforeseen technical issues. However, Rocket Pool's proven track record should mitigate some of these concerns.

Offering an estimated APR of 5.4%, StakeWise sETH2 brings to the table another non-custodial staking solution. Deposits are tokenized on a 1:1 basis into sETH2, with a separate "rETH2" token representing staking rewards.

StakeWise's unique selling point? It offers a straightforward way to stake ETH and earn rewards without dealing with any dynamic exchange rates. To start staking, just use a decentralized exchange like Uniswap to swap your sETH2 or rETH2 into other assets.

Risks? StakeWise's model relies on its upcoming V3 release, which promises users the ability to directly claim their underlying ETH and rewards by burning their sETH2 and rETH2. Until then, users are advised to use decentralized exchanges to swap their tokens, which adds an extra step and a slight risk due to price volatility.

Last but certainly not least, Frax Ether sfrxETH delivers an impressive estimated APR of 6.55%, making it the highest-yielding option on this list. Stakers receive two tokens: frxETH, representing their underlying ETH deposit, and sfrxETH, which accumulates staking rewards.

Why Frax? The advantage of using Frax lies in its high yield and capital efficiency. You can use frxETH in DeFi protocols to generate additional yield, thereby multiplying your earnings. Staking through Frax involves minting frxETH from ETH and swapping frxETH for sfrxETH on the Frax app.

The risks? As the highest-yielding option, it also carries some risks. As with all DeFi platforms, there's the potential risk of smart contract bugs or sudden price fluctuations. Therefore, it's crucial to be comfortable with these risks before staking a large amount of ETH.

Staking for Beginners - How to Choose the Right Platform

User-Friendly Interface

The first and perhaps the most critical factor to consider is the user interface of the platform. The last thing you want is to be navigating through an interface that feels like a maze. Look for a platform that offers a clean, intuitive, and responsive interface - one that makes the staking process feel like a breeze.

But remember, a great interface doesn't just look good; it also provides clear instructions and safeguards. It should guide you through the process, highlighting critical information, explaining jargon, and providing prompt and effective customer support. Platforms like Gitcoin, Rocket Pool, and StakeWise offer interfaces that are intuitive and beginner-friendly.

Security

The importance of security in the realm of cryptocurrencies cannot be overstated. Platforms should employ robust security measures, including multi-factor authentication, encryption, and smart contract audits to ensure the safety of your assets.

Furthermore, the platform should have measures in place to handle worst-case scenarios, like hacking attempts or sudden market crashes. For instance, Frax employs a two-token system to increase capital efficiency and provide an additional layer of security.

Reputation

In crypto staking, reputation matters. A platform with a strong reputation is likely to be reliable, trustworthy, and committed to maintaining high standards. Platforms like Rocket Pool have earned their reputation through years of dependable service and a proven track record.

But where can you find information about a platform's reputation? User reviews, expert opinions, and community discussions on platforms like Reddit or Twitter can be invaluable. Keep in mind, though, to be critical and cautious of overly positive or negative reviews that may be biased or manipulated.

Yield Potential

Yield potential is a significant consideration. After all, the primary reason to stake your ETH is to earn rewards. However, it's crucial to remember that yield potential usually correlates with risk - the higher the yield, the higher the risk involved.

Platforms like Frax Ether sfrxETH offer high yields, but they also come with their unique risks. That's why it's crucial to balance your desire for high returns with your risk tolerance.

TL;DR

There's something quite profound about the simplicity of liquid staking. It takes the complex concept of Ethereum staking and distills it into a neat, user-friendly process. With liquid staking, there's no need for technical wizardry or an in-depth understanding of the crypto landscape - you simply stake your ETH and watch as the rewards start rolling in.

The surge in liquid staking's popularity is a testament to its effectiveness and appeal. It's opening up a new avenue for everyone to get involved and earn from the thriving Ethereum ecosystem. And with projects like Gitcoin, Rocket Pool, StakeWise, and Frax Ether, the ETH staking arena is teeming with user-friendly options for beginners.

There's no one-size-fits-all staking option. What works for one staker might not work for another. So, weigh your options, consider the factors we've discussed, and most importantly, do your own research. That's the true key to successful staking.

If you are looking for other crypto staking services, make sure you also consider Bake, they offer different yield and staking services that work on Ether, and other major coins.

Happy Stacking!