Frax Finance, a leading figure in the Decentralized Finance (DeFi) space, traces its roots back to mid-2019. Originally conceived under the name Decentral Bank, it was the brainchild of the trio - Sam Kazemian, Travis Moore, and Jason Huan. The core of their innovation was the creation of an algorithmic stablecoin protocol. Over time, this entity underwent rebranding and emerged as Frax Finance, with its ecosystem centered around FRAX, their native, USDC-collateralized stablecoin, and the governance token, Frax Share (FXS).

Transformation and Growth of Frax Finance Over the Years

Frax Finance from its humble beginnings as an innovative stablecoin protocol, it gradually expanded its suite of products across various sectors of DeFi and multiple chains.

In its initial years, Frax Finance pioneered a unique model for its FRAX stablecoin, where it was partially collateralized and partially algorithmic. This was an innovative step in the stablecoin landscape, demonstrating Frax's ambition to push the boundaries of the industry. However, following the collapse of algorithmic stablecoin UST in 2023, Frax transitioned FRAX to a fully collateralized model.

Frax Finance didn't stop at just issuing stablecoins. In June 2022, it launched FraxSwap, its native decentralized exchange (DEX), based on Time-Weighted Automated Market Maker (TWAMM). FraxSwap was lauded as the first live implementation of the TWAMM on the market, demonstrating Frax's commitment to constant innovation.

Soon after, Frax Finance further enhanced its ecosystem with the introduction of FraxLend, a money market platform that allowed borrowing of FRAX against collateral. This addition significantly boosted FRAX adoption, thanks to Frax Finance’s active participation in the Curve Wars that steered rewards to FRAX pools.

Over the course of its development, Frax Finance became a multi-chain entity, stretching across 16 different chains and locking in more than $797 million in total value by 2023. This transformation demonstrates how Frax Finance has grown from an algorithmic stablecoin protocol to one of the most innovative builders in the DeFi space. 🚀

Frax Finance's Ground-breaking Innovations

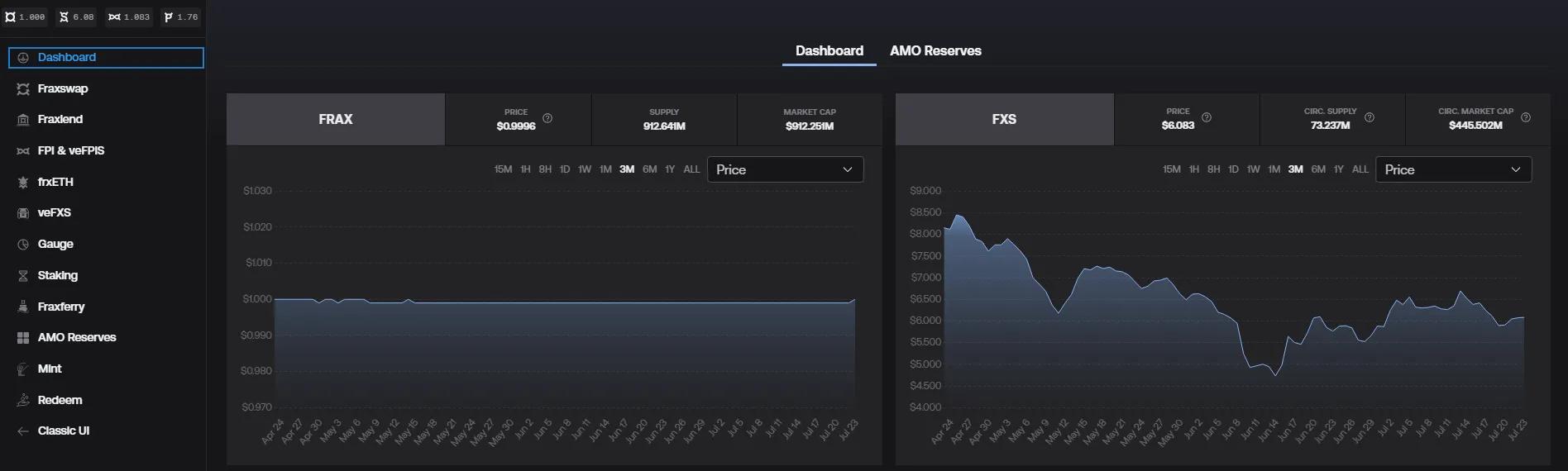

FRAX, the heart of the Frax Finance ecosystem, emerged as a pioneering figure in the realm of stablecoins. As the protocol's native stablecoin, FRAX was initially designed as a partially collateralized and partially algorithmic coin. This was a novel approach that combined the trustless, algorithmic monetary policy with the safety net of collateralization.

However, following the collapse of the algorithmic stablecoin UST in 2023, the protocol made a strategic decision to transition FRAX into a fully collateralized stablecoin. Despite this shift, the groundbreaking essence of FRAX remained intact, reflecting Frax Finance's resilience and willingness to adapt and innovate in response to the changing DeFi environment.

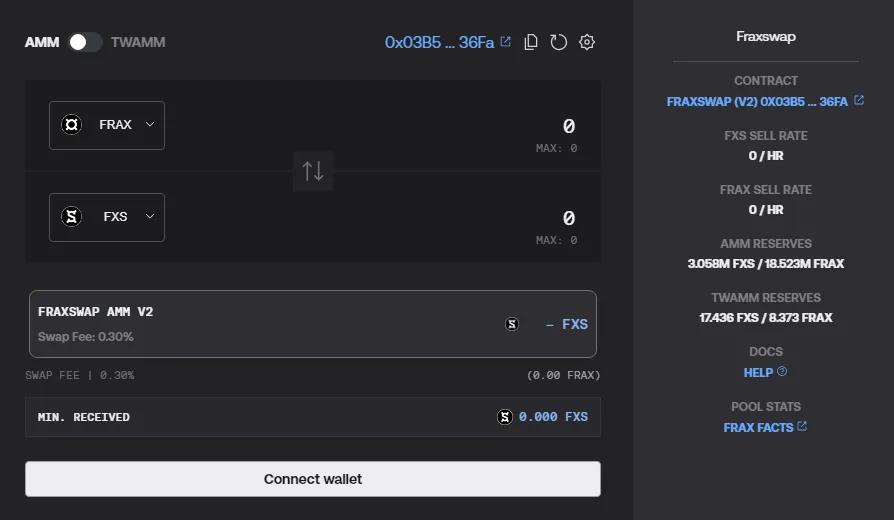

Launch and Significance of FraxSwap

In June 2022, Frax Finance introduced another key product in its suite: FraxSwap. FraxSwap is the protocol's native decentralized exchange (DEX), and it was the first live implementation of the Time-Weighted Automated Market Maker (TWAMM) on the market. This revolutionary mechanism allowed large orders to be processed over time, reducing the chance of substantial price fluctuations - a common pain point in traditional DEXs.

Beyond its inherent utility, FraxSwap also plays an essential role in supporting the broader Frax ecosystem. For example, it facilitates the buyback of FXS tokens from the market, utilizing the profits from Frax Finance's algorithmic market operations (AMOs). These AMOs are designed to generate returns using the collateral in Frax Finance, which form part of the yield for FXS stakers.

Introduction and Impact of FraxLend

FraxLend is another powerful innovation from Frax Finance. Launched shortly after FraxSwap, FraxLend is a money market platform that supports the borrowing of FRAX against assets as collateral. This has not only increased the use cases for FRAX but also boosted its adoption across the DeFi landscape.

Frax Finance’s active participation in the famous Curve Wars was a strategic move that encouraged users to borrow FRAX by directing rewards to FRAX pools. This integration between the lending and borrowing platform and the stablecoin further solidified Frax Finance’s presence in the DeFi space.

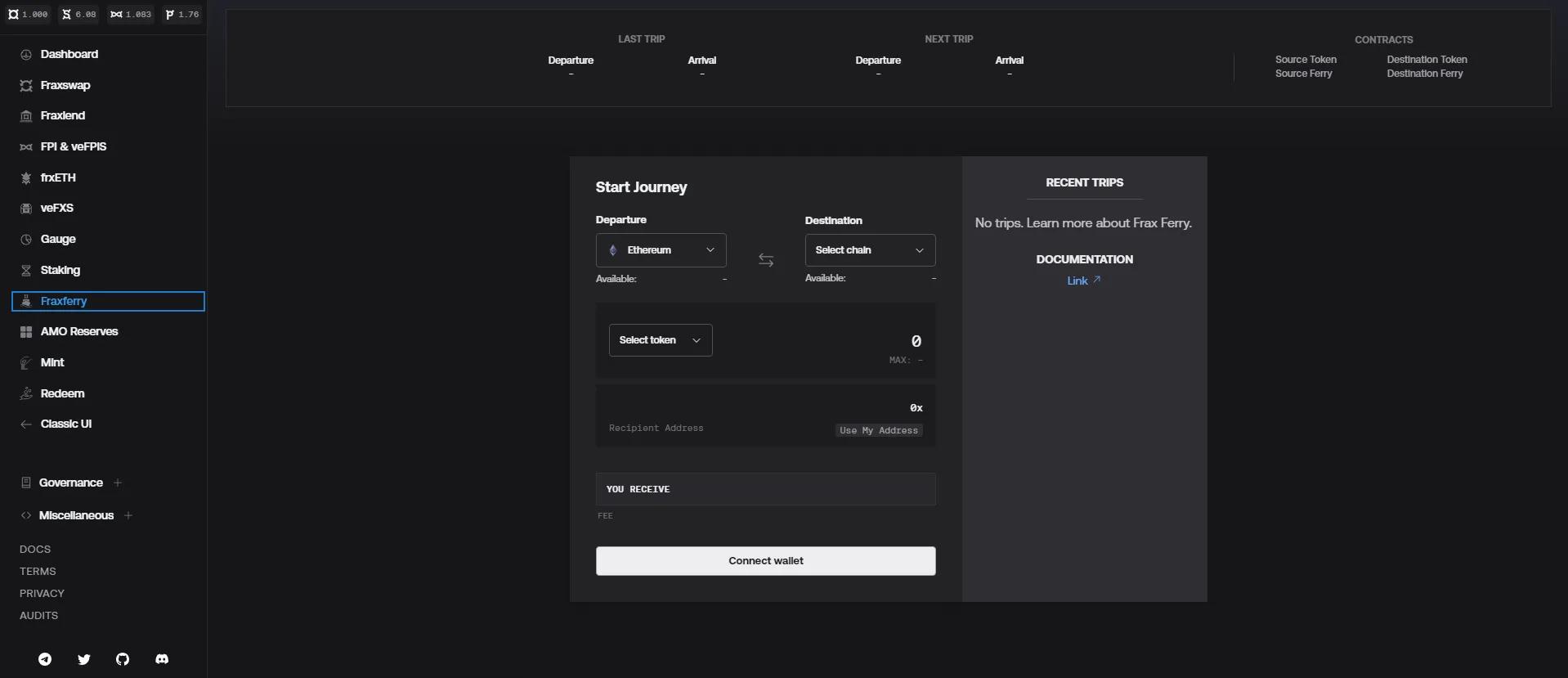

With an ambition to build a truly decentralized and cross-chain financial ecosystem, Frax Finance introduced FraxFerry. As a cross-chain bridging service, FraxFerry enables the seamless transfer of Frax assets across the various chains that Frax Finance supports.

FraxFerry is a critical pillar supporting the protocol's multichain ambitions. By eliminating the barriers between different chains, it significantly enhances the accessibility and usability of Frax's suite of products. This, in turn, contributes to the overall value and appeal of the Frax ecosystem in an increasingly interconnected and cross-chain DeFi landscape.

Frax's Entry into Liquid Staking Derivative Space

In October 2022, Frax Finance marked its entry into the liquid staking derivative (LSD) space with the launch of Frax Ether (frxETH). This was a significant development that pitted Frax Finance against established market leaders like Lido and Rocket Pool.

Frax Ether (frxETH) signalled a strategic move towards harnessing the potential of Ethereum's staking economy. frxETH is essentially a staking derivative token representing staked Ether (ETH) in the Frax ecosystem. While it was only launched in late 2022, frxETH rapidly grew to become one of the protocol’s most important products, especially as the narrative around LSD gained traction leading up to the Ethereum Shanghai upgrade in 2023.

Evolution and Significance of frxETH V2

Frax Finance took the concept of liquid staking a step further in May 2023 with the introduction of frxETH V2. This innovative upgrade reframed the notion of liquid staking derivatives as lending ETH to validators to earn "interest", where the yield received by stakers is essentially an interest payment.

In the frxETH V2 model, deposited ETH in the Frax ecosystem is lent out to Ethereum node operators. These operators provide the required collateral and pay a certain interest rate to borrow the ETH from Frax Finance. The interest payments on these loans are then distributed to frxETH stakers as yield.

The launch of frxETH V2 represented an important evolution of Frax's LSD offering. By aligning the interests of ETH lenders, node operators, and stakers, frxETH V2 not only increases the attractiveness of the Frax ecosystem for Ethereum stakers but also creates a positive feedback loop that reinforces the value proposition of Frax Finance as a whole.

Frax Finance's Multichain Expansion

As a pioneering decentralized finance protocol, Frax Finance has been ambitious in its efforts to foster a truly interconnected, cross-chain financial ecosystem. This pursuit has resulted in Frax Finance expanding its presence across an impressive range of 16 different blockchain chains.

Frax Finance's multichain expansion serves as a testament to its commitment to decentralization and interoperability. By bridging multiple chains, it allows for seamless transfer and utilization of Frax's suite of products across various ecosystems. The key enabler of this wide-ranging cross-chain compatibility has been FraxFerry.

This multichain presence has enabled Frax Finance to tap into a broader user base and cater to diverse DeFi use cases, positioning it as a truly global and chain-agnostic DeFi protocol.

Overview of Total Value Locked (TVL) in Frax Finance

One key indicator of a DeFi protocol's success and trustworthiness is the total value locked (TVL) within its ecosystem. For Frax Finance, this figure stands at over $797 million, as of our current timeline.

TVL essentially represents the amount of assets that are currently staked or deposited in the protocol, serving as an indicator of the level of engagement and trust the community places in the platform. Frax Finance's high TVL signifies that a considerable amount of resources is being utilized within the Frax ecosystem, indicating a high level of user engagement and trust in the platform.

This substantial TVL, coupled with Frax's wide-ranging multichain presence, underscores the protocol's significant influence and robustness in the rapidly evolving DeFi landscape. As Frax continues to innovate and expand, it will be interesting to watch how these numbers grow in response to the protocol's future developments.

Unveiling of Fraxchain

Recently, Frax Finance added another feather to its cap with the announcement of Fraxchain, its own Layer 2 (L2) solution. Fraxchain was unveiled by Frax Finance founder, Sam Kazemian, in a podcast episode with Flywheel DeFi, generating a buzz within the DeFi community.

Designed as a hybrid rollup, Fraxchain aims to enhance the scalability, finality, and security of the Frax ecosystem. It represents a significant step forward in Frax Finance's ongoing efforts to push the boundaries of decentralization and interoperability in the DeFi sector. Fraxchain is currently expected to launch by the end of 2023.

Technical Comparison with Existing Layer-2 Solutions

Unlike many of the existing L2 solutions, Fraxchain will combine the technologies of both Optimistic rollups and zero-knowledge rollups (zk-rollups). The rollup architecture of Fraxchain is built on Optimism, but with integrated zero-knowledge proofs.

This hybrid design sets Fraxchain apart from other L2s and is believed to offer better scalability, faster transaction finality, and enhanced security compared to its competitors. Furthermore, Fraxchain has been hinted to fully utilize account abstraction contracts instead of Externally Owned Accounts (EOAs), which opens doors to increased programmability for users on the chain.

Unique Integration of frxETH as the Gas Token

In a departure from the norm, Fraxchain is planned to use frxETH, rather than ETH, as the gas token on the chain. FraxFerry will be integrated with Fraxchain from launch to ensure sufficient liquidity of frxETH on the chain.

The use of frxETH for gas has multiple implications. Gas fees will be paid out to holders of vote-escrowed FXS (veFXS), which is obtained through locking FXS tokens. This mechanism not only adds further value to FXS stakers but also creates an innovative synergy between the LSD product frxETH and the Fraxchain infrastructure.

Potential Benefits of Fraxchain to the Frax Ecosystem

Fraxchain brings multiple potential benefits to the Frax Finance ecosystem. Firstly, by using frxETH as the gas token, it directly influences the supply dynamics of frxETH, potentially increasing the overall yield for staked frxETH (sfrxETH) holders and making frxETH more attractive against other LSD solutions.

Moreover, a successful Fraxchain could help Frax Finance consolidate its position in the LSD market and capture a larger market share. By creating a layer-2 solution that is fully integrated with its existing suite of products, Fraxchain could reinforce the interconnectedness and user experience of the Frax ecosystem, driving more users to Frax's suite of services and amplifying the value proposition of the Frax Finance platform as a whole.

Future Prospects of Fraxchain

One particularly interesting aspect of Fraxchain is its intended use of account abstraction. Currently, most blockchain platforms use Externally Owned Accounts (EOAs), which are controlled by private keys and have a limited set of operations.

However, Fraxchain plans to utilize account abstraction contracts, a novel concept that offers increased programmability. This means that accounts on Fraxchain will function like "fully programmable bank accounts," as Sam Kazemian puts it.

Account abstraction could significantly expand the range of financial operations available to users on Fraxchain, providing a more versatile and user-friendly experience. This capability could make Fraxchain a more attractive platform for developers and users, thereby potentially boosting the adoption of Frax Finance’s suite of services.

As of now, Fraxchain is scheduled to launch by the end of 2023. As we approach the launch date, more detailed information about Fraxchain's testnet and mainnet is expected to be confirmed.

In the lead-up to the launch, the Frax Finance community and the broader DeFi sector will be keenly observing how the development of Fraxchain progresses. While Frax Finance has already established itself as a leading innovator in the DeFi space, the success of Fraxchain could cement its position as a leading player in the field of blockchain and DeFi.

Indeed, the launch of Fraxchain could mark a significant milestone in Frax Finance's journey and the broader DeFi landscape. Given Frax Finance's track record of delivering innovative products and features, expectations are high for Fraxchain and its potential to drive further growth and innovation within the Frax ecosystem and beyond.

Frax Finance, since its inception, has come a long way, evolving from an algorithmic stablecoin protocol into an innovative ecosystem of DeFi products and services. From the launch of FRAX, the first partially collateralized and partially algorithmic stablecoin, to the rollout of FraxSwap, FraxLend, FraxFerry, and frxETH, Frax Finance has consistently pushed the boundaries of DeFi innovation.

Its transformation over the years, driven by the vision of its founders, Sam Kazemian, Travis Moore, and Jason Huan, and their adept team, highlights Frax Finance's commitment to innovation and user-centric design. The protocol has proven to be adaptable and progressive, adapting its model in response to market developments and pioneering novel DeFi concepts.

Expectations and Future Outlook for Fraxchain

If successfully launched and adopted, Fraxchain could mark a significant leap in the DeFi space. By linking its LSD product to the gas economics of its Layer-2 chain, Frax Finance could create a robust economic loop that further reinforces the value proposition of its ecosystem.

Moreover, Fraxchain's impact could extend beyond the Frax Finance ecosystem, potentially triggering a new wave of innovation in the DeFi sector. The success of Fraxchain could inspire other DeFi projects to integrate their tokenomics more tightly with their technical infrastructure, leading to more holistic and interconnected DeFi ecosystems.

TL;DR

Frax Finance has evolved from a pioneering algorithmic stablecoin protocol to a comprehensive DeFi ecosystem with diverse offerings. FRAX, its stablecoin, originally partially collateralized and algorithmic, moved to a fully collateralized model after the collapse of algorithmic stablecoin UST in 2023. Frax launched FraxSwap, the first live implementation of the Time-Weighted Automated Market Maker (TWAMM), and FraxLend, a lending platform that increased FRAX's adoption.

The platform's offerings were extended with the launch of FraxFerry, a cross-chain bridging service, and their entry into the liquid staking derivative (LSD) market with Frax Ether (frxETH). In May 2023, Frax introduced frxETH V2, a lending model where ETH is lent to Ethereum node operators, earning interest for stakers. Frax expanded to 16 chains, demonstrating its commitment to decentralization and interoperability, with a total value locked (TVL) of over $797 million by 2023.

The announcement of Fraxchain, a hybrid rollup Layer-2 solution, signifies a major step in Frax's journey, aiming to boost scalability, finality, and security. This unique L2 combines Optimistic and zk-rollups and uses frxETH as the gas token, rewarding FXS stakers. This could increase yield for staked frxETH holders, strengthen Frax's LSD market position, and enhance its value proposition. Fraxchain is expected to launch by the end of 2023.