DeFi represents a shift from traditional, centralized financial systems towards an ecosystem that is open, global, and permissionless. DeFi offers a spectrum of financial services — from lending and borrowing to insurance and trading — all conducted on blockchain technology, largely on Ethereum.

Amidst this rapidly growing DeFi landscape, a plethora of tools have emerged to track, monitor, and analyze the data within the sector, including our own (Pro Intelligence Dashboard, Market Metrics, Market Indicators, and On-Chain Indicators)

One of these tools is DeFiLlama, an analytics platform for DeFi projects. DeFiLlama provides data regarding total value locked (TVL), project rankings, chain data, and other crucial information related to DeFi projects.

DeFiLlama was developed in response to the increasing complexity and growth of the DeFi sector. Its origins can be traced back to 2021, a year in which the DeFi industry experienced unprecedented growth. Amidst the booming popularity of blockchain-based decentralized applications (dApps), there was an apparent need for an encompassing platform to track these rapidly evolving projects. Hence, DeFiLlama was created with the goal of providing transparent, accessible, and accurate data for everyone interested in DeFi.

The purpose of this article is to provide an in-depth understanding of DeFiLlama, its key functionalities, and its value within the DeFi space. It also aims to shed light on how DeFiLlama is shaping the trajectory of the DeFi sector, thereby promoting a greater understanding and appreciation of decentralized finance as a whole. The insights presented here will not only cater to seasoned DeFi enthusiasts but also to beginners who are interested in diving into the world of DeFi

DeFi Sector Overview with DefiLlama

Understanding Total Value Locked (TVL)

Total Value Locked (TVL) is a key metric in the DeFi space, representing the amount of assets currently staked in a specific protocol, platform, or the entire DeFi sector. In simpler terms, TVL indicates the value of all tokens currently held in a DeFi protocol. It serves as an indicator of the trust and utility of a particular protocol or platform. The larger the TVL, the more capital is participating in the protocol, thus suggesting greater market confidence.

How to Interpret DeFi Charts on DeFiLlama

DeFiLlama presents comprehensive charts displaying trends in TVL across individual protocols and the DeFi sector as a whole. Interpreting these charts involves understanding the variables involved, namely time, TVL, and specific protocols.

For example, if you're reviewing the TVL chart of a particular DeFi protocol, the y-axis represents the TVL (in USD), and the x-axis denotes time. An upward trend signifies an increasing TVL, indicating that more assets are being locked into the protocol over time, a potential sign of increased trust and usage.

Similarly, DeFiLlama provides charts comparing different DeFi projects based on their TVL. This can be particularly useful to understand the popularity and trust in different protocols, and to observe the impact of market events on them.

Insight into Trends in TVL and Trading Volumes

Using DeFiLlama, one can observe and analyze trends in TVL and trading volumes across various DeFi projects. This provides valuable insights into the relative performance and popularity of different protocols, and the overall health of the DeFi market.

An increasing TVL trend could imply growing trust and participation in a DeFi protocol, or the DeFi sector in general. On the other hand, sudden drops might signal underlying issues or decreased confidence in a protocol or the sector.

Similarly, trading volumes are a significant indicator of the activity level on a particular DeFi platform. Higher trading volumes usually signify high user activity and liquidity. However, sudden spikes in volume may also indicate market volatility or drastic events.

Exploring Different Chains

Overview of Chains Section

The Chains section on DeFiLlama provides a comprehensive overview of the various blockchain networks hosting DeFi protocols. Each blockchain has its unique advantages, and the popularity and growth of DeFi protocols on these chains often reflect their respective features.

In the Chains section, DeFiLlama lists the various blockchains, including Ethereum, Binance Smart Chain, Polkadot, and more. For each chain, DeFiLlama provides metrics like Total Value Locked (TVL), the number of projects hosted, and the change in TVL over the last 24 hours. This data provides a quick snapshot of the DeFi landscape across different blockchains.

Insight into TVL Breakdowns and Statistics for Individual Chains

For more in-depth analysis, DeFiLlama enables users to dive into individual chain details. Clicking on a particular chain will lead you to a page containing more granular data about that chain's DeFi protocols.

The TVL breakdown is a key feature, presenting the distribution of value among various DeFi projects on the selected chain. The TVL of each protocol is listed, along with its percentage contribution to the total TVL of the chain. This allows users to understand which protocols are the most prominent on a given chain.

Additional statistics provided include daily, weekly, and monthly changes in TVL, presenting an accurate picture of the trends in DeFi activity on each chain.

Utilizing Filters and Features for Analysis

To facilitate more customized analysis, DeFiLlama offers various filters and features. Users can filter data based on chains, categories of DeFi protocols (like DEX, lending platforms, etc.), and the timeline for which the data is displayed.

For example, you can filter to only see DeFi protocols on the Polygon chain, or only DEX’s across all chains. The timeline filter allows users to view TVL changes over different periods - from the last 24 hours up to a year. These filters are incredibly useful when tracking trends or comparing different chains or protocols.

Moreover, features like the 'Watchlist' enable users to monitor specific protocols, and the 'Compare' tool allows side-by-side comparison of different protocols or chains.

Diving Deeper Into Individual Chains

Overview of Chain-Specific Pages

Chain-specific pages on DeFiLlama provide a deep-dive into individual blockchain networks. These pages are designed to furnish detailed insights on every DeFi protocol operating on the selected chain. By presenting granular data and robust analytical tools, these pages enable users to gain a comprehensive understanding of the DeFi ecosystem on the chosen chain.

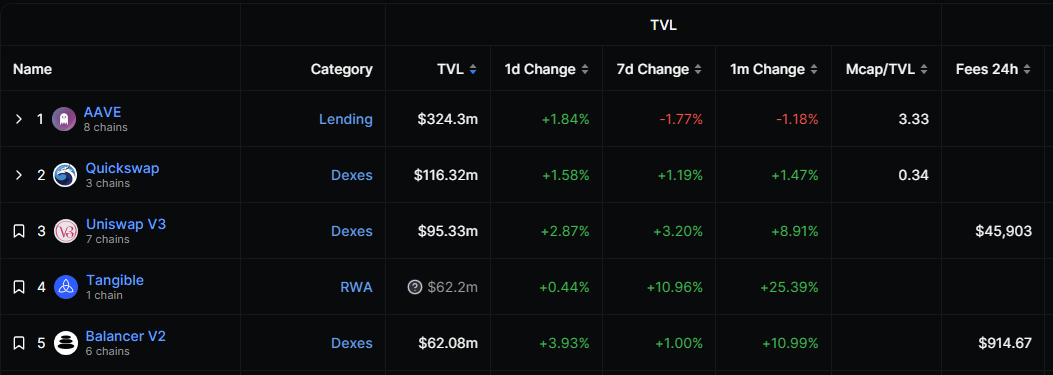

Each chain-specific page presents a list of all DeFi protocols on the chain, along with their corresponding Total Value Locked (TVL) in USD and the change in their TVL over the last 24 hours. You can also view the chain's total TVL and its ranking among all chains.

Insight into Dominant Protocols on the Chain

A critical aspect of the chain-specific pages is identifying dominant DeFi protocols on the chain. These protocols typically have the highest TVL and often dictate the trends and directions of the chain's DeFi ecosystem. By exploring these dominant protocols, users can understand which services are most trusted and used by the community.

Each protocol is accompanied by a brief description, providing an overview of its purpose and operations. Users can click on individual protocols to visit their specific pages for more detailed information, including their historical TVL data, links to their official websites and social media channels, and other relevant information.

Introduction to TVL Range Filters and Protocol Comparisons

DeFiLlama equips users with sophisticated tools to facilitate detailed analysis. The TVL range filter is one tool, enabling users to adjust the range of TVL values displayed on the charts. This filter is particularly useful when users want to focus on specific periods of high volatility or significant changes in the TVL of the chain or a protocol.

Moreover, the 'Compare' feature comes into play when users want to draw comparisons between different protocols on the chain. By selecting the protocols they're interested in and clicking on 'Compare,' users can view a side-by-side comparison of these protocols' TVLs over time. This feature allows users to understand the relative performance of different protocols and identify any correlations or divergences in their trends.

Fees and Revenue Analysis

Explanation of Fees and Revenue Metrics

In the world of Decentralized Finance (DeFi), fees and revenue metrics are vital to understanding a protocol's profitability and operational efficiency. These metrics typically include, but are not limited to, transaction fees, withdrawal fees, governance token rewards, on-chain metrics, market metrics, and interest earned on pooled assets. All these elements play a pivotal role in defining the total revenue generated by the protocol.

Transaction fees are costs that users incur when they execute transactions on the protocol. Withdrawal fees apply when users retrieve their assets from the protocol. Governance token rewards refer to the tokens that users earn for participating in the protocol's governance, and interest earned relates to the profits made from lending assets in liquidity pools.

Revenue metrics, on the other hand, include the total revenue generated by the protocol, revenue per user, and profit margin. These metrics provide insight into the protocol's profitability and its potential for growth.

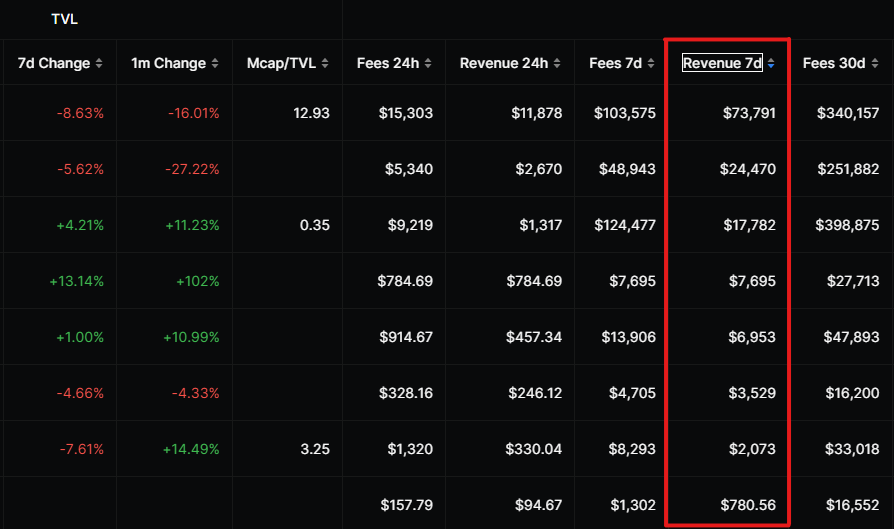

Detailed Breakdown of Profitability per Protocol

DeFiLlama provides a detailed breakdown of each protocol's profitability. The 'Revenue' tab on each protocol's page displays a timeline of the protocol's revenue over a given period. By analyzing this information, users can understand how the protocol's profitability has changed over time and what factors may have contributed to these changes.

Furthermore, the 'Fees' tab provides a list of all the fees associated with the protocol, along with their respective amounts. This feature allows users to calculate the costs associated with using the protocol and understand how these fees contribute to the protocol's total revenue.

Filtering Protocols by Categories for Focused Investments

To streamline the investment process, DeFiLlama allows users to filter protocols by categories. Users can choose categories such as lending, DEXes, derivatives, assets, and more to focus on a specific type of DeFi protocol. By leveraging this feature, users can target their investments towards protocols that align with their investment goals and strategies.

For instance, a user interested in yield farming could filter for protocols in the 'Yield Farming' category and focus their analysis on these protocols. Similarly, users can filter for 'Low-Risk Protocols' if they are more conservative investors.

Analyzing Protocol Treasury and Expenses

Introduction to Protocol Expenses and Treasuries

Protocol expenses and treasuries play a critical role in the financial health and sustainability of a DeFi project. A protocol's expenses encompass all the costs it incurs to maintain its operations, develop new features, pay salaries, and fund marketing initiatives. These expenses are often funded by the protocol's treasury, which is a pool of funds (often in the form of cryptocurrency) held by the protocol for such expenses.

Importance of Burn Rate and Treasury Value

The burn rate, which refers to the rate at which a protocol spends its treasury, is an essential metric in assessing a protocol's financial health. A high burn rate might indicate that the protocol is overspending and may run out of funds if the trend continues, potentially leading to its failure.

On the other hand, the treasury value represents the total value of assets the protocol holds in its treasury. A high treasury value is typically a positive sign as it implies that the protocol has sufficient funds to cover its expenses and invest in future growth.

Analyzing these two metrics in tandem can provide valuable insights into a protocol's financial sustainability and its potential longevity in the market.

Risk-Free Value (RFV) Strategy🔥

The Risk-Free Value (RFV) investing strategy is a novel approach in the DeFi space that relies on assessing the treasury and liabilities of DeFi protocols. This strategy involves investing in protocols whose token price is less than the risk-free value of their treasury, minus liabilities.

In other words, if the token price is less than the net value of the protocol's treasury, the protocol is considered undervalued, presenting a potential buying opportunity. Conversely, if the token price is higher, the protocol may be overvalued.

The RFV investing strategy can be a powerful tool for identifying undervalued investment opportunities in the DeFi space. However, it should be used in conjunction with other analyses and metrics as the DeFi market is influenced by a variety of factors beyond treasury and liability values.

Exploring Yields in the Pools Tab

Overview of Yields Section

The Pools tab on DefiLlama provides a comprehensive look at the yields available across different liquidity pools in the DeFi space. Yields refer to the returns that liquidity providers (LPs) can earn by staking their tokens in these pools. The yields are usually represented as Annual Percentage Yields (APY) and vary based on factors like the liquidity of the pool, the underlying protocols, and the risks associated with the pool.

Utilizing Filters for Focused Yield Farming

DefiLlama offers several filters in the Pools tab to help users find the most suitable yield farming opportunities. Users can filter pools based on chains, categories, and risk levels. They can also sort pools by TVL, yields, or rewards.

For instance, if a user is interested in yield farming on the Ethereum network with stablecoins, they can use the filters to display only those pools that match these criteria. This functionality makes it easier for users to find pools that align with their risk tolerance, investment strategy, and preferred blockchain.

Breakdown of Rewards between Base APY and Reward APY

The yield provided in a DeFi liquidity pool typically comprises two parts: Base APY and Reward APY. The Base APY is the return earned from the interest generated by the pool, while the Reward APY comes from additional tokens distributed by the protocol as incentives for liquidity providers.

DefiLlama clearly delineates between these two components, providing a detailed view of the expected returns from each pool. Understanding this breakdown is critical as it allows investors to assess the sustainability of the yields. While the base APY is usually more stable, the reward APY can be highly volatile and dependent on the token's price, which could significantly impact the total yield.

Advanced Yield Strategies

Introduction to Advanced Farming Strategies

While yield farming can be a profitable venture, it is not without risks and complexities. Therefore, some investors may choose to employ advanced farming strategies to optimize their returns and hedge against potential risks. These strategies typically involve multiple steps, complex interactions with different protocols, and in-depth understanding of DeFi dynamics. Examples of such strategies include long-short farming, leveraged lending, and impermanent loss mitigation.

Explanation of Long-Short and Leveraged Lending Strategies

Long-short farming involves simultaneously entering long (buy) and short (sell) positions in a token. This strategy aims to profit from the yield generated by the long position, while the short position provides a hedge against potential price depreciation of the token.

Detailed Guide on Executing Individual Strategies

Implementing these advanced yield farming strategies requires a keen understanding of DeFi protocols, risk management, and careful execution. Here's a brief overview of how to execute these strategies:

Long-Short Farming: To implement this strategy, an investor would need to take a long position in a yield farming pool by staking tokens. Simultaneously, they would short the same token on a platform that supports token shorting. This strategy can protect the investor against potential price depreciation of the token, while still earning yield from the long position.

Leveraged Lending: To execute this strategy, an investor would need to borrow funds from a lending protocol at a certain interest rate. They would then stake the borrowed funds in a yield farming pool that offers a higher return than the borrowing rate. However, they should be aware of the potential risks involved, including liquidation if the collateral's value falls below a certain threshold.

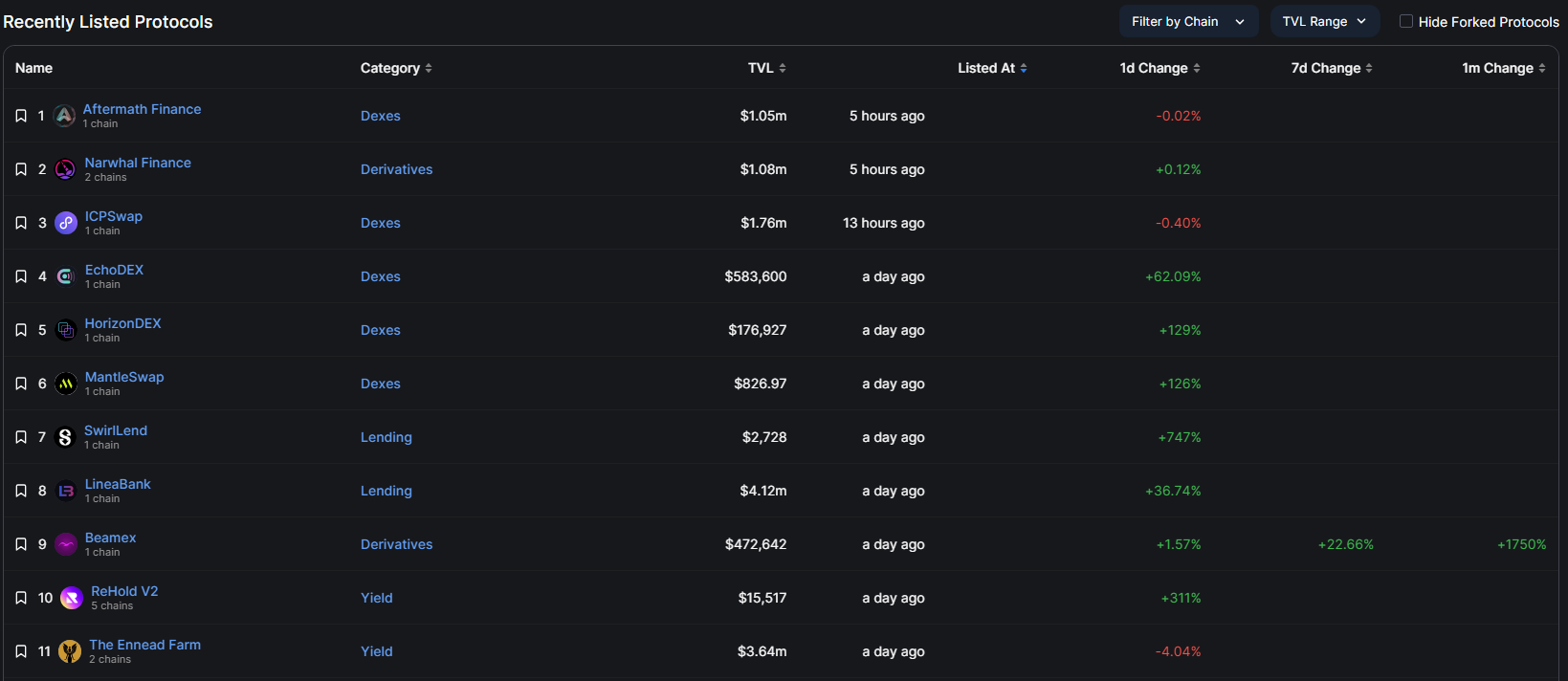

Discovering Newly Listed Protocols in the Recent Tab

One of the intriguing aspects of DeFi is its fast-paced environment, with new protocols and investment opportunities appearing constantly. Staying updated with these developments can be a daunting task. The 'Recent' tab on DeFiLlama provides a solution to this issue by listing the newly added protocols on the platform. This feature allows users to explore fresh opportunities, ensuring they stay up-to-date with the rapidly evolving DeFi landscape.

Recommendations for Risk Assessment and Due Diligence

While the 'Recent' tab provides a convenient way to discover newly listed protocols, it's crucial to note that new protocols often come with increased risks. The DeFi space has seen several cases of scams, rug pulls, and protocol failures. Thus, investors should conduct a thorough risk assessment and due diligence before investing in any new protocol.

Here are some recommendations for due diligence:

Protocol Review: Study the project's whitepaper and documentation. Understand its purpose, the problem it aims to solve, and how it plans to do so. Look for any innovative features or mechanisms that might give it a competitive edge.

Team Analysis: Investigate the team behind the project. Are they experienced and reputable in the industry? A transparent and knowledgeable team can often indicate a project's potential for success.

Smart Contract Audit: Has the protocol's smart contract been audited? An audit by a reputable firm can help uncover potential security vulnerabilities.

Community Engagement: A strong and active community can be a positive indicator of a protocol's health. Evaluate the project's social media channels and community discussion forums.

Market Analysis: Consider the market conditions. Is the protocol entering an oversaturated market, or does it offer a unique solution?

Airdrop Hunting in the Airdrop Tab

In the world of cryptocurrency and DeFi, an airdrop refers to the process where a blockchain project distributes tokens or coins to the wallets of some users free of charge. Airdrops are commonly used by blockchain-based startups to spread the word about their project and incentivize wider adoption.

Tips and Strategies for Successful Airdrop Hunting

While airdrop hunting can be rewarding, not all airdrops will result in substantial gains. Here are a few tips and strategies to make your airdrop hunting more successful:

Do Your Research: Not all airdrops are created equal. Some tokens may have real value, while others might be worth very little. Research the project behind the airdrop and make sure it's a legitimate and promising one.

Active Participation: Many projects require certain activities or actions before you can qualify for an airdrop. This could be anything from signing up for a newsletter, joining a telegram group, or even interacting with the project's smart contracts.

Early Adoption: Often, early adopters of a protocol are the ones who get the most lucrative airdrops. Staying updated with the DeFi space and being among the first to interact with new projects could increase your chances of receiving valuable airdrops.

Monitor Airdrop Platforms: Regularly check platforms like DeFiLlama that track and list upcoming airdrops. This can help you stay ahead and not miss out on any opportunities.

Safe Practices: Never share sensitive information like your private key. Legitimate airdrops will never require such details. Always keep your safety and the security of your digital assets as the top priority.

TL;DR

The burgeoning DeFi sector, with its myriad of protocols, chains, and tokens, offers exciting opportunities for everyone from the casual investor to the experienced trader. However, the sheer scale and complexity of the DeFi landscape can be overwhelming. This is where tools like DeFiLlama come in.

DeFiLlama serves as a comprehensive, reliable guide to the DeFi universe. It offers insight into the latest trends in Total Value Locked (TVL), trading volumes, fees, and revenues across different chains. With its detailed breakdowns, customizable filters, and robust features, DeFiLlama provides valuable data-driven insights that can aid informed decision-making and strategy formulation. From understanding the dominant protocols on individual chains to exploring the yields of various pools, DeFiLlama covers it all.

The world of decentralized finance is still in its early days, yet it is changing rapidly. As protocols evolve and new ones emerge, the landscape continues to shift. Therefore, continued exploration and learning are crucial for anyone seeking to thrive in the DeFi space.

In this regard, remember that tools like DeFiLlama are your allies. Make the most of the features they provide and stay updated with the latest trends and opportunities. As you delve deeper into individual chains, yield farming strategies, or even airdrop hunting, remember that each step brings you closer to mastering the dynamic world of DeFi.

While the journey might seem daunting at times, remember that the rewards of understanding and navigating the DeFi landscape can be significant. So, keep exploring, keep learning, and remember that the world of DeFi is at your fingertips, ready to be discovered. Here's to your success and growth in the vibrant universe of decentralized finance!